Taxpayers have been urged to check for any lost or unclaimed superannuation, as the Australian Taxation Office (ATO) revealed it is holding $17.8 billion worth of unclaimed funds.

The ATO also warned people who have already retired, that they too could be in for a retirement savings boost, with $471 million of that unclaimed super being held on behalf of people aged 65 plus.

“Many Australians have forgotten to update their contact details, so their super fund can’t find them,” ATO Deputy Commissioner Emma Rosenzweig said on Tuesday.

“If you’ve changed job, moved house or simply forgotten to update your details, you may have lost or unclaimed super … more money in retirement may be on the table.”

Lost superannuation is when the money is being held by a super fund which can no longer find you. When those funds are transferred to the ATO for safe keeping after some time, it becomes known as unclaimed superannuation.

“All your super accounts including lost and ATO-held super are displayed on ATO online services,” ATO said.

The ATO has reunited Australians with $6.4 billion of unclaimed super since 2021, but a staggering amount of unclaimed super still remains in its hands.

Anyone who has changed their job, name, address, for example, may benefit from completing a checklist which the ATO calls its five-step Super Health Check.

Taxpayers and retirees can follow prompts to confirm contact details, check for super balances and employer contributions using ATO online services, and look for lost and unclaimed super displayed online.

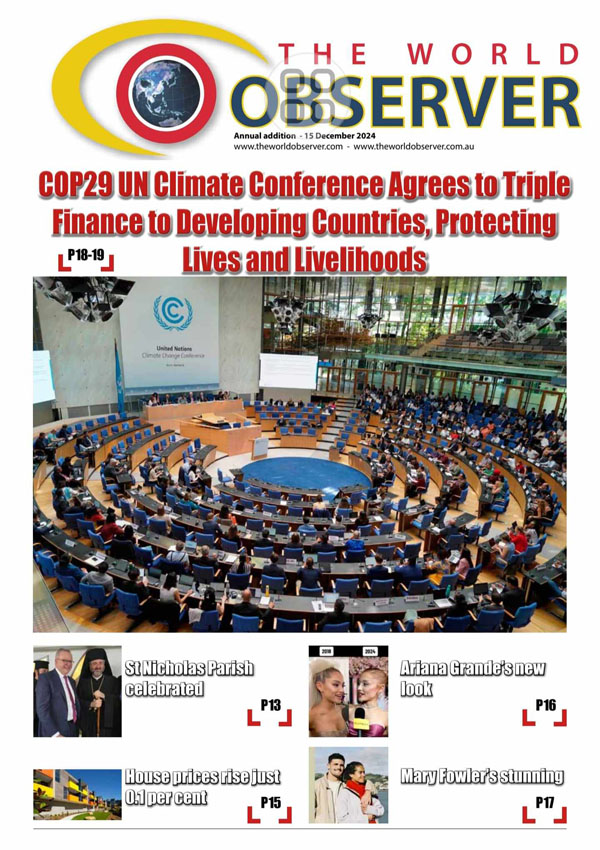

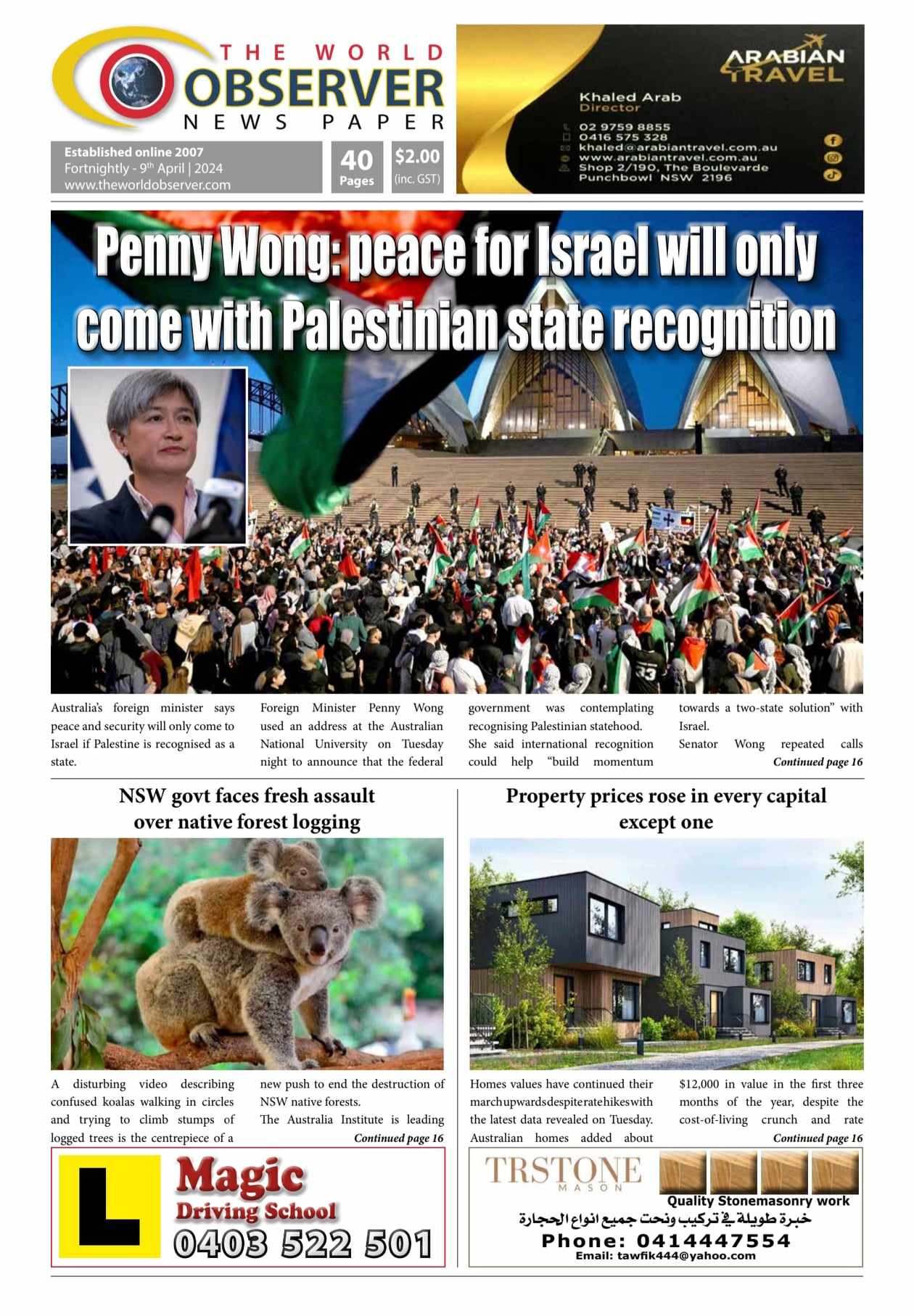

The World Observer Media produces a daily online newspaper, a daily Arabic online newspaper and a monthly printed Arabic/English magazine and a weekly printed Arabic/English newspaper.

The World Observer Media’s mission is to entertain and educate all generation from the Ethnic Communities in Australia, who are interested in local, national and foreign information.

The World Observer Media produces a daily online newspaper, a daily Arabic online newspaper and a monthly printed Arabic/English magazine and a weekly printed Arabic/English newspaper.

The World Observer Media’s mission is to entertain and educate all generation from the Ethnic Communities in Australia, who are interested in local, national and foreign information.